Solicitors Season at LAUW

June is fast approaching, and it’s a big month in the insurance industry for law firms, especially in the professional lines space. LAUW has been providing professional indemnity and management liability coverage solutions for the legal…

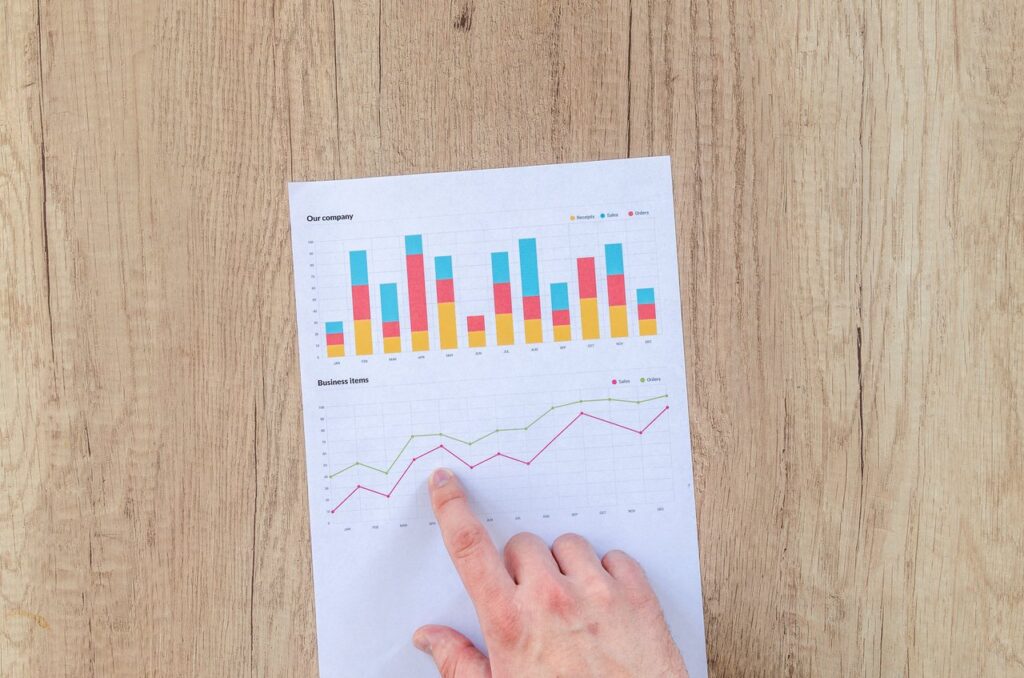

Successful renewal of FI and PI Binders for 2025 – 2026

LAUW is pleased to announce the successful renewal of its Financial Institutions and Professional Indemnity Binders, with effect from 1 April 2025. Financial Institutions Lead syndicate Munich Re continues with its support by expanding its risk…

Cyber-attacks on the rise

Did you know 67% of all data breaches in Australia between January and June 2024 resulted from cyber-attacks*? Threats to cyber security are constantly evolving, with new vulnerabilities emerging as existing ones are mitigated. The Federal…

Protect your business with cyber insurance

London Australia Underwriting has launched a new Cyber Liability product, designed to help your business mitigate risk exposures created by cyber security breaches and related events. Working together with Beazley – pioneers in cyber risk management –…

New Commercial Crime product launched

London Australia Underwriting continues its commitment to innovation and service by releasing a brand-new Commercial Crime product offering first and third-party coverage. Commercial Crime coverage includes employee theft, robbery, extortion, computer fraud, fund transfer fraud and…

It’s solicitors’ top-up season

June is fast approaching and it’s a big month in the insurance industry for law firms, especially for professional indemnity. London Australia Underwriting (LAUW) has been writing cover for solicitors since 2005 and this year we’re…

Talk to LAUW about ComTech and FinTech liability

London Australia Underwriting (LAUW) works together with its supporting brokers to achieve the best outcomes for our mutual clients. If you need IT liability (ComTech) or FinTech covers, talk to us. IT liability (ComTech) Whether you’re…

Talk to LAUW about PI and IT liability

For London Australia Underwriting (LAUW), its supporting brokers are partners in the insurance process. We work together to achieve the best outcomes for our mutual clients. If you need professional indemnity (PI) cover, particularly for SME…

Solicitors’ top-up season

June is almost here and it’s a big month in the insurance industry for law firms, especially for professional indemnity. London Australia Underwriting (LAUW) has been insuring solicitors since 2005 and this year we’re here to…

Solicitors’ top-up season

June is almost here and it’s a big month in the insurance industry for law firms, especially for professional indemnity. London Australia Underwriting (LAUW) has been insuring solicitors for more than a decade and 2022 is no…

Solicitors’ top-up season

June is fast approaching and it’s a big month in the insurance industry for law firms, especially for professional indemnity. London Australia Underwriting (LAUW) has been insuring solicitors for more than a decade and 2021 is no…

For a happy festive season, protect against ransomware

Protect your company from ransomware attacks in the Christmas holidays. Ransomware is a form of malicious software (malware), which is a blanket term for viruses, worms, trojans and other harmful computer programs used by hackers to…

Cyber breaches on the rise

Cyber breaches are on the rise in Australia and the news media has reported on the large number of Australians falling victim to online scammers. In tough times like these, businesses need to be adequately insured…

PI market hikes upwards

Amid the festive cheer, there is not much joy in the professional indemnity (PI) market. The Australian market has previously gone through a period of overcapacity and soft rates, but the market is now hardening. Losses…

PI for brokers, underwriting agencies

LAUW is delighted to announce the release of its new professional indemnity product for insurance brokers and underwriting agencies. All licensed insurance brokers and underwriting agencies must maintain adequate professional indemnity insurance to meet the many…

Solicitors’ top-up season 2019

June is fast approaching and it’s a big month in the insurance industry for law firms, especially around professional indemnity. London Australia Underwriting (LAUW) has been insuring solicitors for more than a decade and 2019 is…

Two-factor authentication for passwords

With security breaches, digital crime and internet fraud on the rise, the importance of protecting your information has never been more vital. LAUW is seeing an increase in emails being breached where hackers have gained access…

Solicitors’ top-up season 2018

London Australia Underwriting (LAUW) has a range of insurance products for solicitors and law firms. Partnership Protection Management Liability (PPML) Many law firms, although not incorporated within the meaning of the Corporations Act, have adopted corporation-style management…

LAUW manages cyber claims fast

More than 230,000 computers in 150 countries have been infected by a cyber attack called WannaCry. The ransomware program targets the Microsoft Windows operating system and demands ransom payments in the bitcoin currency. To find out…

Solicitors’ top-up season 2017

June is fast approaching and it’s a big month in the insurance industry for law firms. London Australia Underwriting (LAUW) has insured law firms for more than a decade and 2017 is no exception. We have…

LAUW’s current hot products

The London Australia Underwriting team had an enjoyable few days attending the 34th annual 2016 NIBA Convention in Melbourne as an exhibitor. Thank you to all the brokers who stopped by to say hello and we…

ComTech – IT liability by design

London Australia Underwriting is proud to release its new IT liability offering, ComTech, to the Australian market. Whether you are seeking cover for a start-up developing the next hit app, a telecommunications company, or an established…

New product – commercial legal expenses

LAUW is delighted to announce the launch of a new product, commercial legal expenses (CLE) insurance. CLE provides cover and access to advice for the legal costs of pursuing or defending certain classes of legal action….

Proudly celebrating 10 years of true independence

London Australia Underwriting has reached an important milestone — 10 years since it was established. LAUW remains truly independent in ownership and continues to write exclusively on behalf of Lloyd’s of London syndicates. LAUW is very…

Cyber security update

Over the past few years there has been a sharp rise in cyber attacks and scams. They include well-publicised breaches against major corporations, including Sony, Kmart, US Postal Service and JP Morgan, and a host of…

Cyber eRisks – exclusive benefit

LAUW has developed a new exclusive benefit for eRisks cyber policyholders. You can now have monthly vulnerability scans with reports emailed to you or viewed via an online dashboard. These health checks are provided by one…

ASIC issues major cyber resilience report

ASIC has just published Report 429 Cyber resilience: Health check to help organisations improve cyber resilience. ASIC chair Greg Medcraft said: “Cyber attacks are a major risk for ASIC’s regulated population and that means cyber resilience is an area…

Extortion in the digital age

Cybercriminals are increasingly using ransomware, malware and hacktivism methods to finance their activities. Australia is not immune – 5% of worldwide ransomware incidents occur here. – Are your clients prepared to deal with these types of…

Cyber eRisk Incident Response Team

Having launched a comprehensive cyber insurance product in 2015, LAUW is pleased to have added a panel of third-party experts who form its Cyber Incident Response Team (IRT). We recognise that many companies do not have…

Cyber Incident Response Team

Having launched a comprehensive cyber insurance product this year, LAUW is pleased to have added a panel of third-party experts who together form its Cyber Incident Response Team (IRT). In recognising that many companies do not…

Product Launch – Cyber eRisks Policy

As technology advances so do the risks your clients face. LAUW is pleased to announce the launch of its Cyber eRisks policy. Did you know? The average cost of a data breach in Australia in 2013…

Management liability online exceeds expectations

Welcome to another London Australia Underwriting News Alert. We would like to thank our supporting brokers for their overwhelming response to the LAUW ML Online platform. Broker feedback has been excellent and we are delighted so…

Management liability online launched

Welcome to another London Australia Underwriting News Alert.] We are pleased to announce the launch of ML Online – an online management liability insurance ‘quote and bind’ resource for today’s time-conscious broker offering: i) Broad coverage…

Partnership Protection Management Liability

LAUW is delighted to announce the launch of our new management liability product tailored specifically for partnerships. Today, many partnership firms, while not incorporated within the meaning of the Corporations Law, have adopted a “corporation style”…

Capacity increases for PI and D&O

Welcome to a London Australia Underwriting Pty Ltd News Alert. We are delighted to announce capacity increases for professional indemnity and directors & officers/management liability. The following increases now apply: Professional indemnity: $20m any one claim…

New IMI wording

LAUW is pleased to announce a new investment managers’ insurance (IMI) wording, with significant enhancements to the existing form. The form is tailored towards long-only equities managers. For a copy of the wording or to answer…

Sydney UAC Expo

The Sydney UAC expo was on March 1, 2012, at the Novotel Brighton Le Sands. It allowed LAUW to engage with new brokers from across Sydney. The event was a huge success. We assisted with brokers’…

Proudly celebrating 5 years of business

Thanks to all the brokers who’ve supported London Australia Underwriting in 2010. We’re now approaching our fifth year in business and have demonstrated constant, profitable growth. LAUW aims to maintain our excellent levels of service throughout…

Our philosophy on claims management

One of LAUW’s most important obligations to policyholders is the way we respond to claims. From the first notification to final settlement or closure of the file, we realise our insureds must receive the very best…

New binding authority

LAUW is delighted to announce the signing of a new binding authority for financial institutions business with Barbican Financial & Professional Consortium, Lloyd’s consortium 9562. The applicable security is 75% Lloyd’s syndicate 1955 (Barbican) and 25%…